By Chase Paxman, Senior Product Manager

Updated January 2026

Tax season doesn’t have to mean chaos.

For school finance and athletic departments, January through April often brings a mountain of manual work — collecting W-9s, cutting checks, tracking down totals, and issuing 1099s. It’s tedious, time-consuming, and error-prone.

That’s why more schools are turning to Arbiter Pay.

Built specifically for K–12 business offices, Arbiter Pay automates the entire payment and tax reporting process, reducing hours of manual labor and ensuring total compliance — all from one simple dashboard.

Arbiter Pay is a game changer for how much organizational time is saved because we don’t have to deal with check requests, voiding, and delivering checks.

— Todd Moeller| Athletic Director, O’Fallon Township HS, IL

The Challenge: Manual Payments and Paperwork Drain Time

Without automation, finance teams spend countless hours:

- Preparing and mailing checks

- Collecting and validating W-9s

- Reconciling hundreds of payments manually

- Preparing 1099s for dozens of officials and vendors

Each task is critical — but together, they create weeks of tax-season stress and increase the risk of missed forms or errors.

How Arbiter Pay Simplifies Tax Season

Arbiter Pay streamlines every step of the payment and reporting process — from digital disbursements to automatic 1099 tracking — giving schools time back and full visibility all year long.

1️⃣ Automated 1099 Tracking and Reporting

Each time a payment is processed through Arbiter Pay, it’s automatically recorded and categorized. At year-end, Arbiter Pay compiles those transactions into IRS-ready 1099-NEC forms — automatically.

✅ No spreadsheets

✅ No math errors

✅ No missing vendors

2️⃣ Secure Digital Payments

Say goodbye to paper checks and manual processes. Arbiter Pay enables fast, secure, and traceable digital payments to officials, coaches, and vendors — instantly.

Funds are transferred directly to Arbiter Pay accounts, allowing recipients to view statements, download 1099s, and track payments whenever they need.

Using paper checks was costing $5–6 per check to process. With Arbiter Pay, we’re down to $2.25 per check. It’s a no-brainer for us.

— Jody Berryhill | Athletic Director, Pine Tree Independent SD, TX

3️⃣ Built-In W-9 Collection

Chasing down forms is a thing of the past. Arbiter Pay securely collects, validates, and stores all W-9s in one place. Each is automatically connected to the correct payee — reducing paperwork and ensuring compliance.

4️⃣ Real-Time Tracking and Reporting

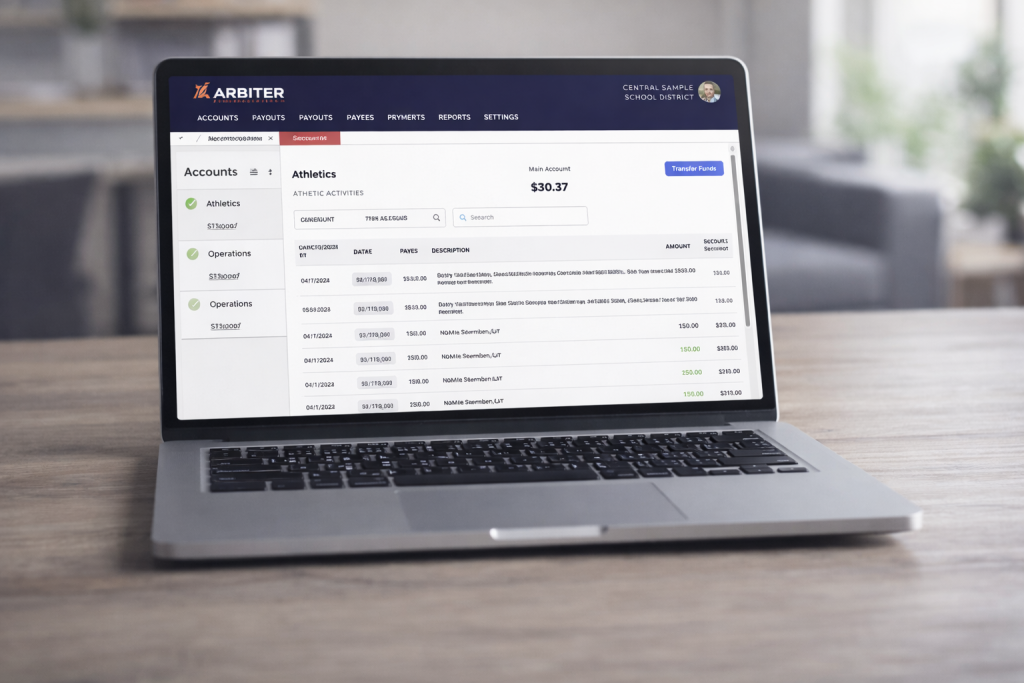

Transparency and accountability are built in. Arbiter Pay’s dashboard provides a real-time view of every account, transaction, and balance across departments.

What you’ll see:

- Balances across Athletics, Operations, and Activities

- Detailed transaction history

- Instant export options for audits or reviews

5️⃣ Compliance You Can Count On

Arbiter Pay meets IRS and district compliance requirements by automatically storing records and generating reports.

Finance teams can instantly access the data they need — no paper binders, no last-minute scrambles.

Let Arbiter Handle the Headache

Tax season will always be busy — but it doesn’t have to be stressful.

With Arbiter Pay, your district can automate payments, simplify reporting, and eliminate paper chaos. It’s faster, simpler, and built for the way schools actually work.

Ready to Simplify Your Tax Season?

🎯 See how Arbiter Pay helps schools automate 1099s, W-9s, and digital payments — saving hours of administrative work.

About the Author

With over a decade at Arbiter, Chase Paxman combines his K–12 and officiating experience to tackle the everyday challenges schools face on and off the field.